Liz Dunford

July 24, 2025

Liz Dunford

July 24, 2025

Brand awareness is one of the most commonly measured metrics in marketing research, but how much do we really understand about how it’s measured? At Potentia, we believe that smart survey design unlocks better brand decisions. So we partnered with Brand Potential to explore something deceptively simple: how the way we ask brand awareness questions impacts the results.

The Challenge: Over-Claim in Brand Awareness

Brand Potential had seen an anomaly in China on energy drink brands: high levels of claimed awareness and purchase intent for a brand that wasn’t even available in the market. This over-claim wasn’t entirely surprising, as it’s a known issue in certain regions. But what causes it? And more importantly, can we reduce it through better survey design?

Testing Question Types

To investigate, we conducted a survey across eight countries, involving over 9,600 respondents, with a focus on the soft drinks category. We tested three distinct question types:

- Standard Multicode: A list of brands where respondents select all they recognise.

- Binary Yes/No: Respondents answer yes or no to whether they’ve heard of each brand.

- Carousel: A detailed question asking respondents to define their relationship with each brand, from regular purchase to never having heard of it.

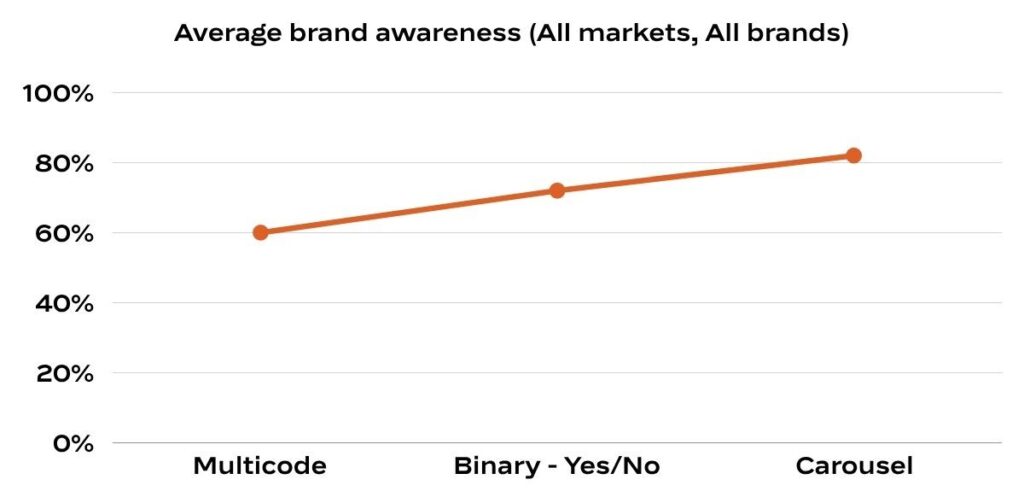

Question Type Really Matters

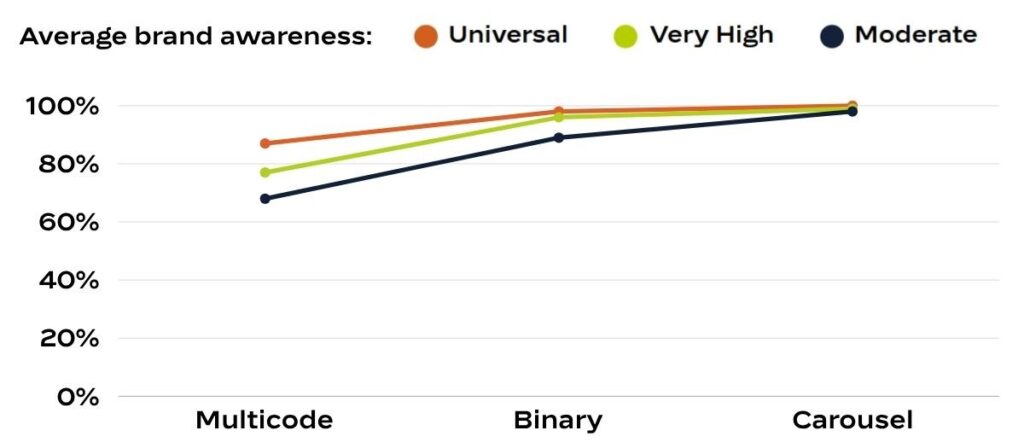

-

Average claimed awareness was 60% for the multicode format

-

That jumped to 72% with the binary format

-

And soared to 82% with the carousel-style question

The importance of question type depends on what you’re testing

For the best-known brands (e.g. Coca-Cola), we saw a 13% difference in average awareness between the carousel and the multicode question types. Whereas for brands that are, on average, less well-known, the difference was 32%.

To dig deeper, we tested some other factors in the survey design and found:

- Logo vs. No Logo: Using logos rather than text doesn’t usually make a difference, unless your brand isn’t commonly known by its full or official name.

- Short vs. Long Lists: Longer brand lists led to slightly lower awareness, likely due to respondent fatigue.

- Honesty Prompts: Had a limited impact on results

Introducing Fizzora: The Fake Brand

Including a fake brand gives a good indication of how your question is performing. It won’t be perfect (people can always convince themselves they’ve heard of a brand), but if it’s high, then that’s an indication you might want to rethink your question.

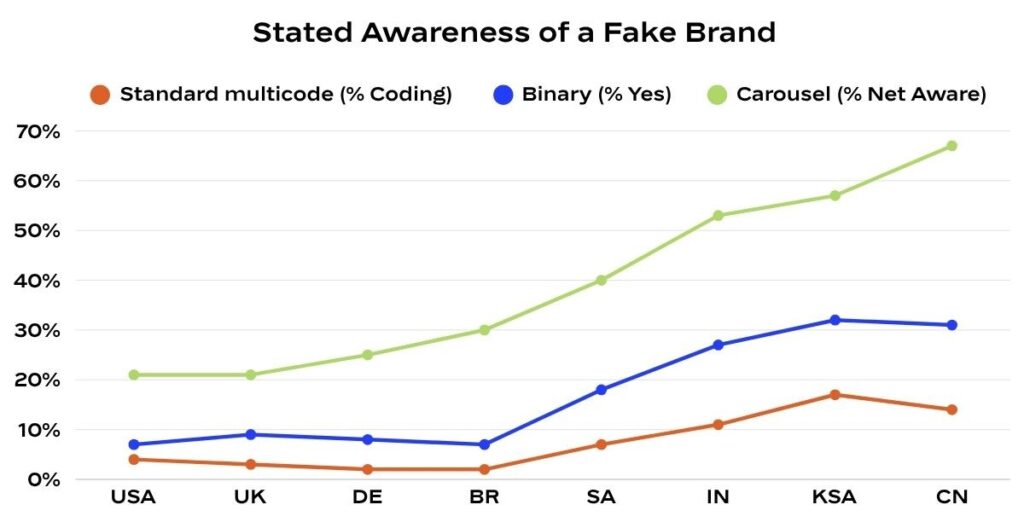

In our study, awareness of Fizzora ranged from 2% in Germany to 17% in Saudi Arabia when participants were asked in a multicode format. Again, we observed the impact of question type, with awareness on the carousel question ranging from 21% in the UK to 67% in China.

Claimed awareness was highest in countries with more collectivist cultures, where concepts like “saving face” or authority bias might subtly influence answers. It’s a crucial consideration when running brand tracking studies across international markets.

What This Means for Measuring Brand Awareness

If you’re running a brand awareness tracker, here’s what to keep in mind:

- Choose your question type deliberately — and consistently

- Test using a fake brand to identify misclaim

- Don’t assume global data is always comparable

- Understand cultural context and respondent psychology

- Educate stakeholders on the nuances of brand awareness data

Download the Full Report

To dive deeper into the data, explore the nuances of cultural dynamics, and uncover actionable insights for your brand, download the full report today.

At Potentia Insight, we’re committed to helping brands navigate the complexities of global research. Let’s work together to uncover the truths that drive meaningful connections with consumers.